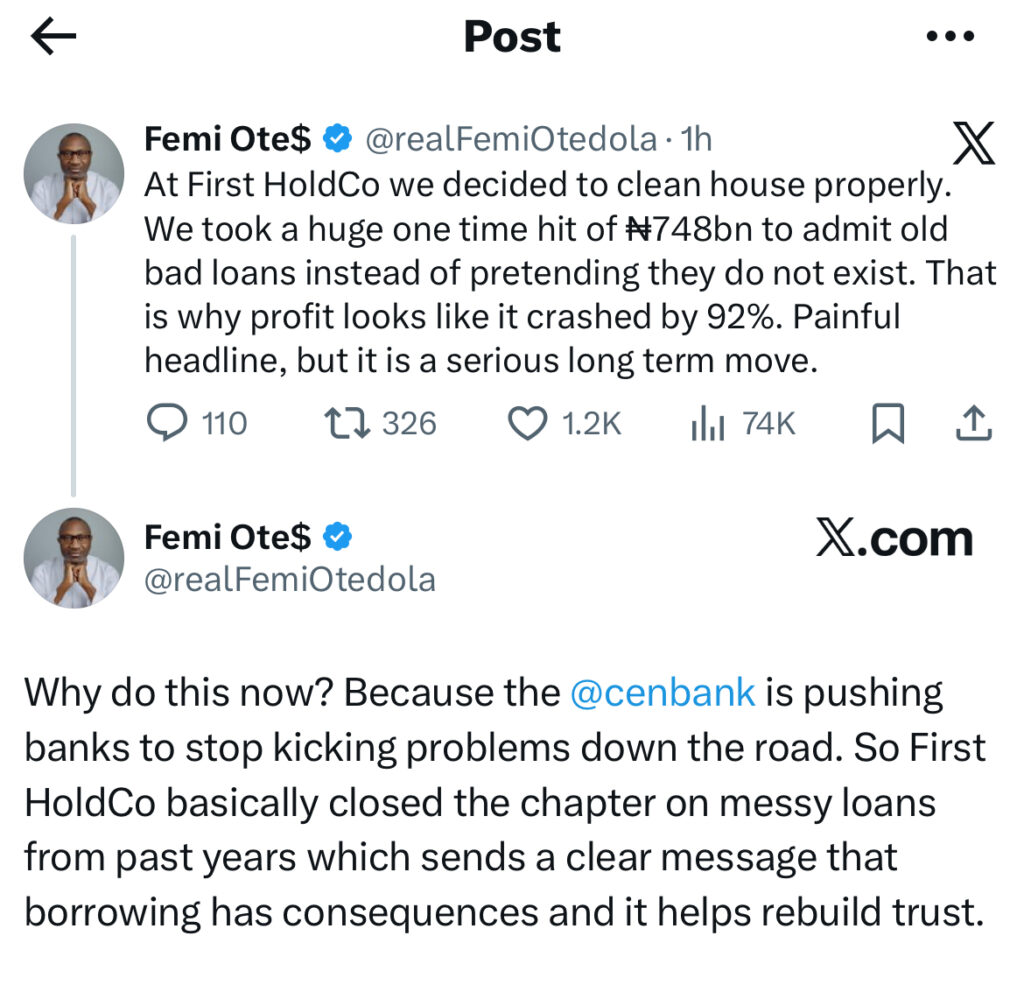

Billionaire investor and business leader Femi Otedola has addressed widespread reactions to First HoldCo’s latest financial results after the group reported a sharp 92 percent drop in profit, a development that triggered intense debate across financial circles and social media.

In a detailed post shared on X, formerly Twitter, Otedola explained that the decline was the result of a deliberate and strategic decision to absorb ₦748 billion in legacy bad loans, rather than continue to roll them forward on the balance sheet. According to him, the move was necessary to properly reset the institution and prepare it for the future of Nigeria’s banking sector.

“At First HoldCo we decided to clean house properly,” Otedola wrote. “We took a huge one-time hit of ₦748bn to admit old bad loans instead of pretending they do not exist.” He acknowledged that the resulting profit figures made for painful headlines but insisted the decision was a serious long-term move rather than a sign of operational weakness.

The comments came after First HoldCo’s financial statement showed a dramatic fall in bottom-line profit, sparking speculation about the health of the banking group. Otedola’s clarification was aimed at reassuring investors, customers, and regulators that the core business of the institution remains strong.

Otedola explained that the timing of the clean-up was not accidental. He pointed to ongoing pressure from the Central Bank of Nigeria, which has intensified its push for banks to stop deferring problematic assets and instead confront non-performing loans head-on. According to him, the regulator’s stance encouraged First HoldCo to close the chapter on messy loans accumulated over previous years.

“Why do this now? Because the CBN is pushing banks to stop kicking problems down the road,” he stated. By taking the hit upfront, the group sent a clear signal that borrowing has consequences and that transparency is essential for rebuilding trust in the banking system.

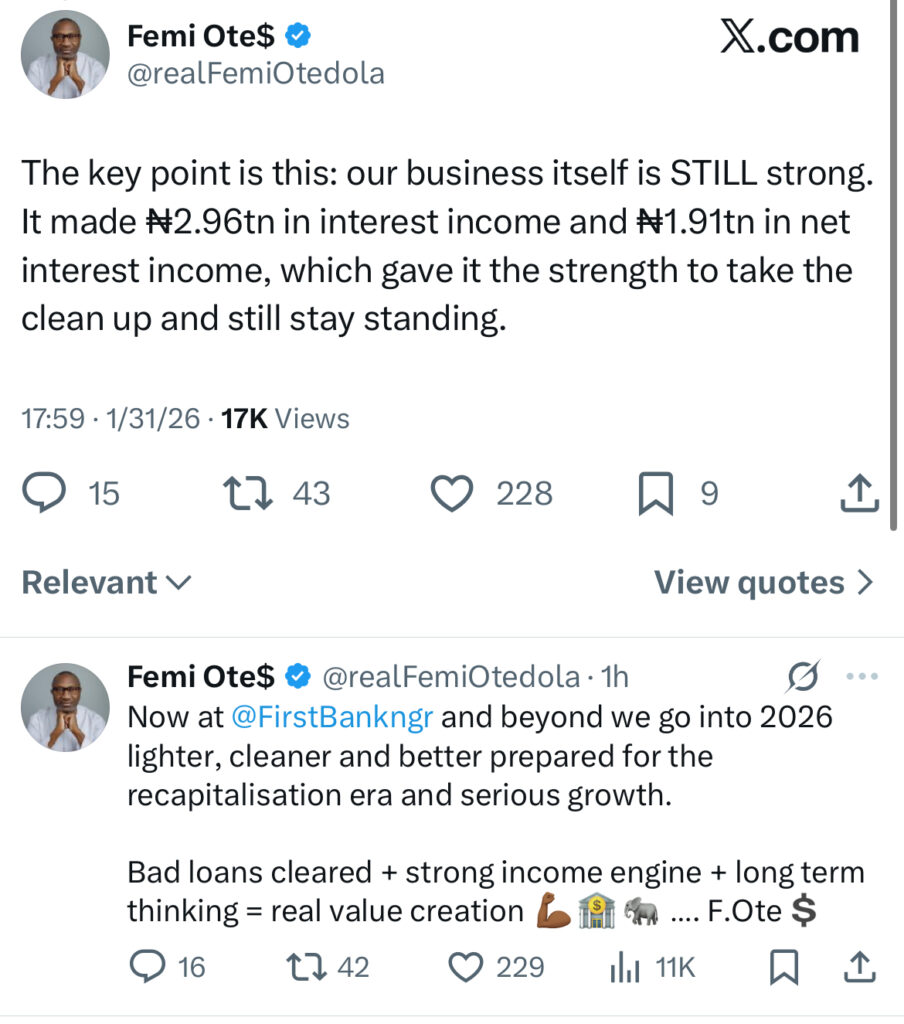

Despite the accounting impact of the loan write-offs, Otedola emphasised that First HoldCo’s underlying business remains robust. He disclosed that the group generated ₦2.96 trillion in interest income and ₦1.91 trillion in net interest income, figures he said provided the strength needed to absorb the clean-up without destabilising operations.

“The key point is this: our business itself is still strong,” Otedola said, stressing that the earnings power of the institution allowed it to take the painful step while remaining financially sound.

Femi Otedola is a major shareholder and influential figure at First HoldCo, the holding company of First Bank of Nigeria, one of the country’s oldest and most systemically important financial institutions. Since increasing his stake, Otedola has been vocal about the need for stronger governance, transparency, and long-term value creation within the bank.

His latest comments position the loan clean-up as part of a broader effort to prepare First HoldCo for the upcoming banking recapitalisation era, which will require stronger balance sheets and higher capital buffers across the sector. Otedola said the institution is entering 2026 “lighter, cleaner and better prepared” for serious growth.

Market analysts note that while the profit decline appears severe on paper, one-off clean-ups of this scale are often viewed favourably in the long term, especially when driven by regulatory alignment and balance sheet discipline. By recognising losses upfront, banks can reset expectations and refocus on sustainable lending.

Otedola summed up the strategy as a combination of cleared bad loans, a strong income engine, and long-term thinking, describing it as “real value creation.” His remarks have since shaped public understanding of the results and reframed the conversation around First HoldCo’s financial position.

As Nigeria’s banking sector adjusts to tighter regulation and higher capital requirements, First HoldCo’s approach is likely to remain a reference point in discussions about transparency, reform, and institutional resilience.

Leave a Reply