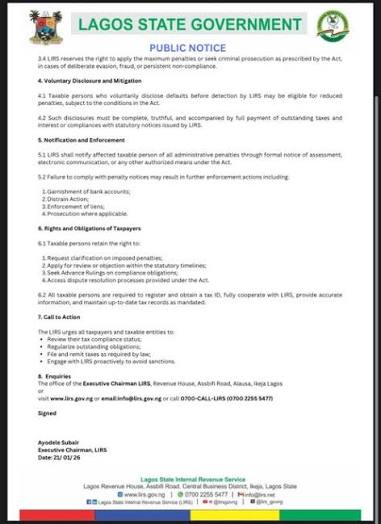

The Lagos State Government has announced plans to intensify tax enforcement by recovering unpaid taxes directly from banks and third-party institutions, a move aimed at boosting internally generated revenue and curbing tax evasion.

The development was disclosed by the state’s tax authorities, who said the action is backed by existing tax laws that empower the government to appoint banks, employers, and business partners as collection agents for defaulting taxpayers.

How the Process Will Work

Under the arrangement, once a taxpayer is confirmed to be in default and has failed to respond to multiple notices, the government can legally issue a directive to banks or third parties holding funds on behalf of the individual or company.

Those institutions would then be required to deduct the outstanding tax liability directly and remit it to the Lagos State Government.

Officials stressed that the measure is not new but is now being more strictly enforced, following years of revenue leakages caused by non-compliance.

The government explained that the policy targets chronic tax defaulters, including businesses and high-net-worth individuals who deliberately avoid paying personal income tax, withholding tax, or consumption-related levies.

According to tax authorities, compliant taxpayers have nothing to fear, as enforcement will only apply after due process, including assessments, reminders, and opportunities for reconciliation.

Lagos State’s tax officials cited relevant provisions of tax laws that allow third-party recovery, emphasizing that the move aligns with global best practices used in major economies.

While some residents have raised concerns about the potential impact on businesses and cash flow, others have welcomed the development, arguing that tax compliance is essential for funding infrastructure, healthcare, education, and public services across the state.

The state government urged residents and businesses to regularize their tax status promptly, warning that enforcement actions would increase in the coming months.

Authorities also encouraged taxpayers facing genuine financial difficulties to engage the tax office early, noting that installment plans and dispute resolution mechanisms remain available.

As Lagos continues to expand infrastructure and social services, officials say improved tax compliance remains critical to sustaining development without excessive borrowing.

Leave a Reply