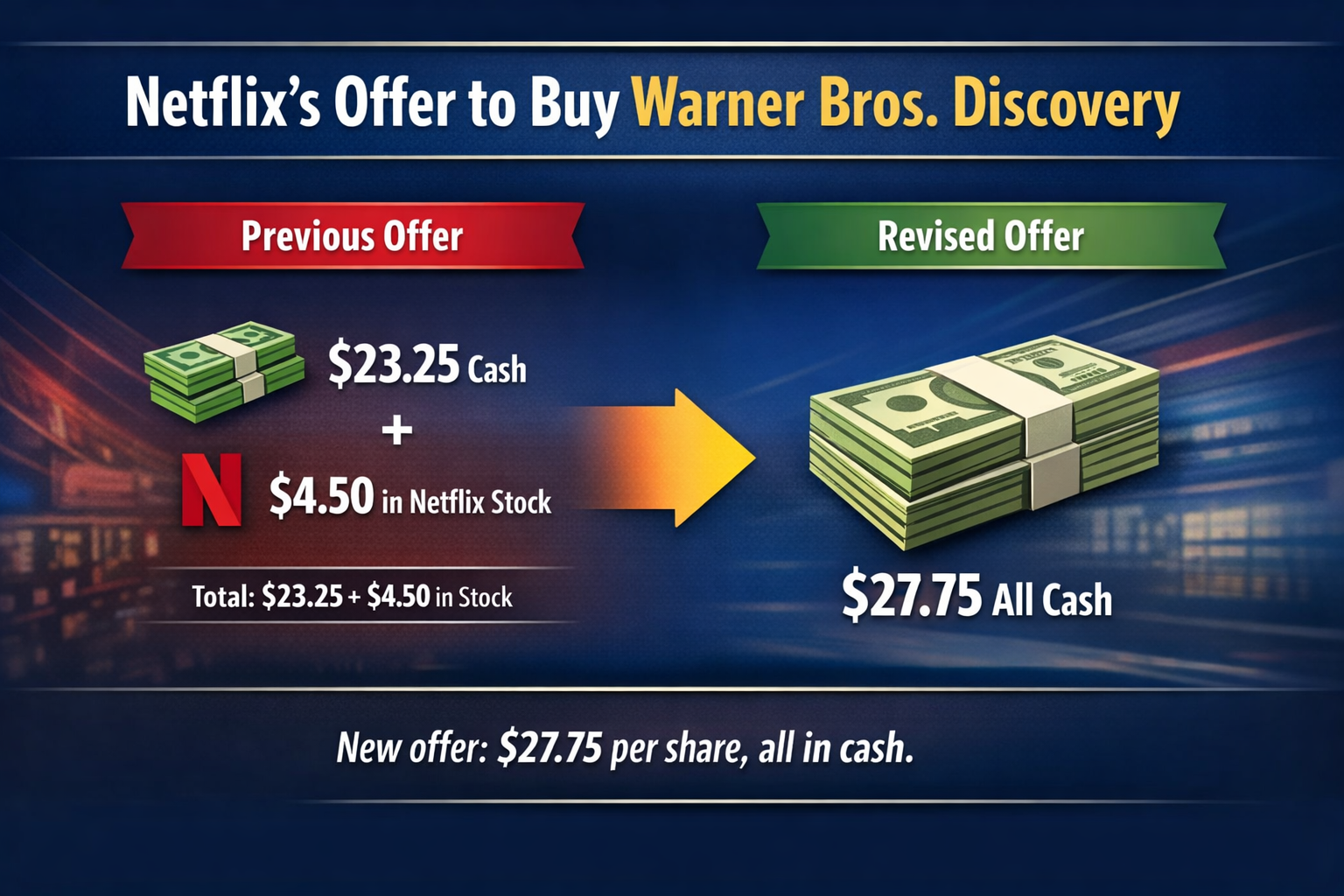

Netflix has revised its plan to acquire Warner Bros. Discovery (WBD), causing a major change to its $83 billion offer. The streaming giant now plans to pay $27.75 per WBD share entirely in cash, instead of the previous mix of cash and Netflix stock. The move comes as a way to strengthen Netflix’s offer against a rival bid from Paramount Skydance.

The original deal, approved by WBD’s board, offered shareholders $23.25 in cash plus $4.50 worth of Netflix shares per share. The new all-cash offer gives shareholders a fixed, guaranteed amount, protecting them from fluctuations in Netflix’s stock price and potentially speeding up the approval process. Netflix hopes WBD shareholders will vote on the deal by April 2026.

Netflix and Warner executives have framed the revised deal as a major step for the entertainment industry. Warner Bros. Discovery CEO David Zaslav said the merger would bring together “two of the greatest storytelling companies in the world” and allow more people to enjoy the content they love. Netflix co-CEO Ted Sarandos added that the all-cash offer provides financial certainty for shareholders and supports an expedited shareholder vote.

The merger, if approved, would combine Netflix’s massive streaming platform with WBD’s vast library of movies, TV shows, and HBO Max content. Executives said the combination would increase production capacity, expand investment in original content, and create more jobs across the U.S. entertainment sector.

Analysts see the cash offer as a strategic move to counter Paramount Skydance, which is pursuing a hostile bid for WBD. By offering a higher, guaranteed payout, Netflix strengthens its position and reassures WBD shareholders that they are receiving the best deal.

WBD’s shareholders now face a choice: approve Netflix’s revised cash offer, consider competing bids, or hold out for another offer. Industry observers say that combining Netflix and WBD could reshape the global entertainment landscape, giving Netflix even more content to attract subscribers and compete with rivals like Disney+, Amazon Prime, and Apple TV+.

If the deal goes through, Netflix would gain hundreds of movies, TV shows, and the HBO Max platform, creating one of the largest entertainment companies in the world.

Leave a Reply