In 2026, financial growth is no longer about working harder alone. It’s about learning smarter, earning better, and investing intentionally. With inflation, changing economies, and new income models, staying financially relevant means learning from people who understand money in today’s reality, especially within the Nigerian context.

Here are trusted Nigerian finance and investment creators whose content can help you scale your income, improve money habits, and build long-term wealth in 2026.

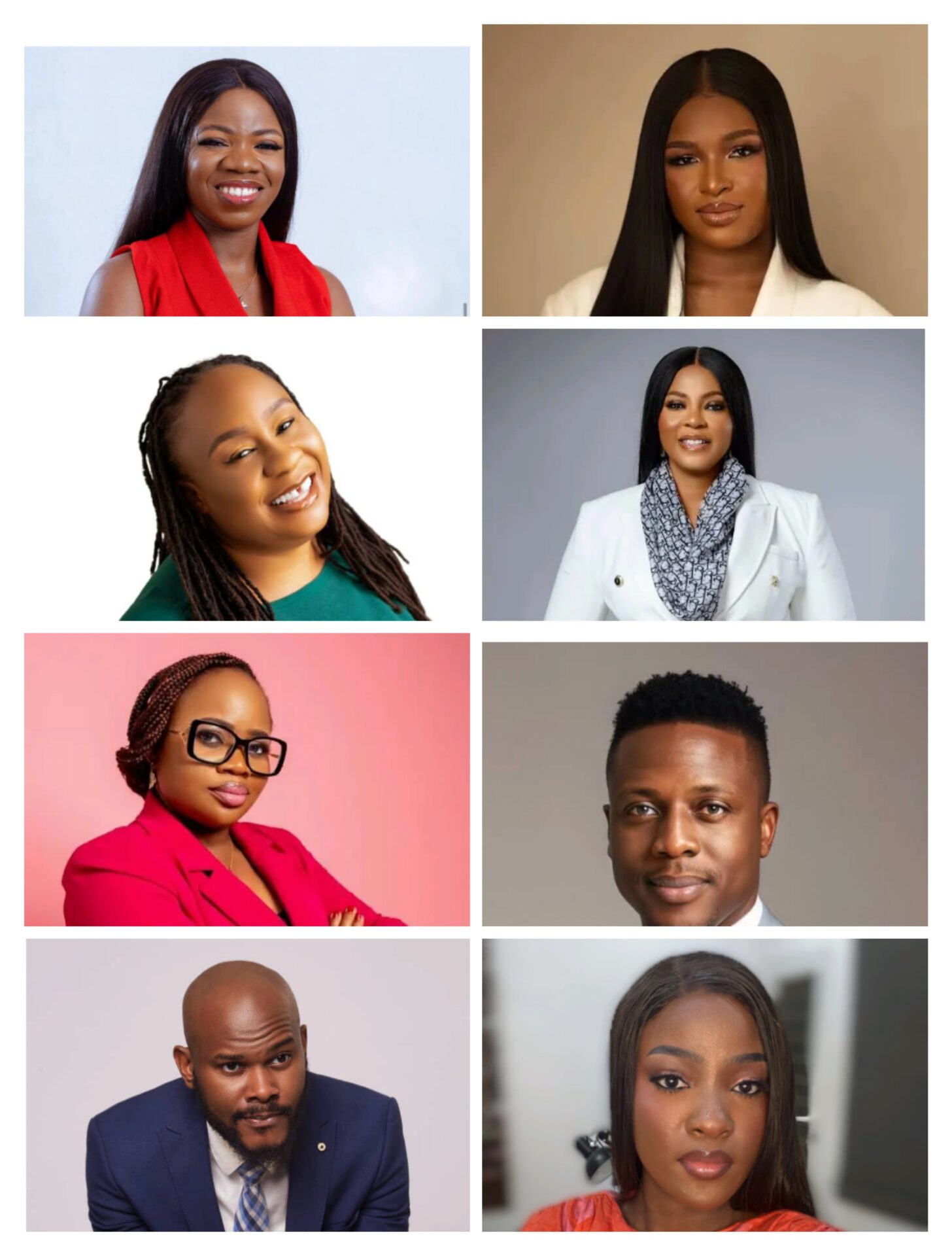

1. Financial Jennifer

Jennifer Awirigwe popularly known as Financial Jennifer is the founder of Fintribe. She breaks down money conversations in a simple, practical way. From budgeting and emergency funds to investments and wealth planning, her content is ideal for anyone trying to build structure and discipline around money.

Handle: @financialjennifer

Her Core Focus: Personal finance, saving, investing, and financial literacy (especially for women)

2. That Online Banker (Stanley C. Onuorah)

Known for his clear and relatable explanations, That Online Banker helps people understand how money works within banks, systems, and real-life scenarios. His content helps followers make smarter financial decisions and avoid costly mistakes.

Handle: @thatonlinebanker

His Core Focus: Banking insights, personal finance education, and money psychology

3. Chioma Ifeanyi Eze

Chioma is the Founder of Accounting Hub. She is also a chartered accountant. Chioma teaches finance from a technical yet very practical angle. Her content is excellent for understanding numbers, accountability, and how to structure your finances for long-term independence.

Handle: @accountinghub.ng and Chioma Ifeanyi Eze on Facebook

Her Core Focus: Accounting, financial literacy, and money management for Africans

4. Grace Ofure

Grace Ofure focuses on the mindset behind money and wealth creation. She helps people unlearn limiting beliefs about money and adopt habits that support sustainable financial growth and abundance.

Handle: @graceofure

Her Core Focus: Wealth coaching, money mindset, and financial growth strategies

5. Personal Finance Girl (Oluchukwu Chiadika)

Her page is perfect for beginners. Personal Finance Girl simplifies money management and shows how small daily decisions can compound into major financial results over time.

Handle: @personalfinancegirl

Her Core Focus: Budgeting, saving, and everyday money habits

6. Sola Adesakin

Sola Adesakin is known for teaching wealth creation with structure and clarity. Her content focuses on helping individuals and families build sustainable wealth through informed financial decisions.

Handle: @solaadesakin

Core Focus: Wealth management, financial education, and investment planning

7. Adeife Adeoye

Adeife brings a modern approach to finance by teaching people how to earn better using digital skills and remote opportunities. Adeife is the founder of Remote WorkHer. Her content is especially valuable for young professionals, remote workers, and creatives looking to increase income beyond salaries.

Handle: @adeifeadeoyeHer

Core Focus: Income growth, remote work, monetizing skills, and financial independence

8. Seyi Abiodun

Seyi Abiodun teaches finance from lived experience, making his content very relatable. He focuses on practical steps to escape debt, grow income, invest, and build wealth gradually but consistently.

Handle: @seyideassistant

His Core Focus: Financial literacy, budgeting, investing, and financial freedom. Money affects every area of life; from peace of mind and opportunities to freedom and legacy.

In 2026, understanding finance is no longer optional. It determines how well you survive economic changes, grow income, and secure your future.

Scaling your finances means:

- Earning beyond one source of income

- Investing instead of just saving

- Understanding money systems

- Making intentional, informed financial decisions

Following the right finance creators helps you learn faster, avoid costly mistakes, and stay motivated on your wealth journey.

You don’t need to know everything about money, but you must be willing to learn. By following these creators consistently and applying what you learn, 2026 can be the year your finances truly level up.

Your money can grow. Your mindset can expand. And your financial story can change – one smart decision at a time

Leave a Reply